Licensed bankruptcy

trustee in insolvency

Together we can find a solution

in only 30 minutes.

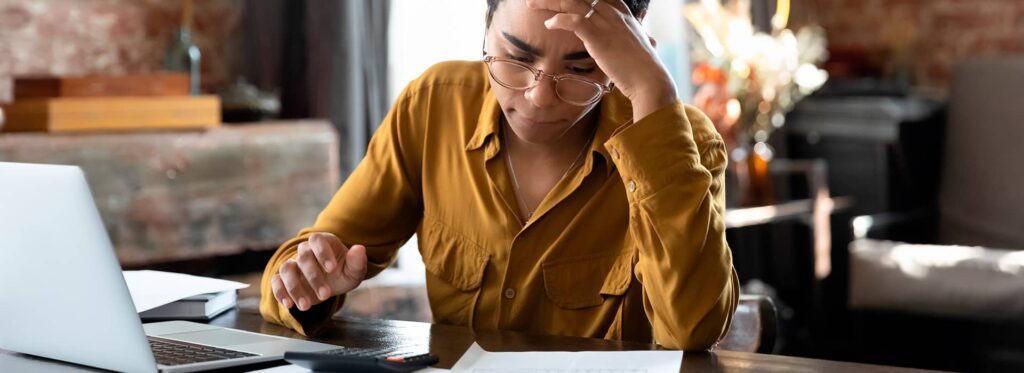

We believe that everyone deserves a second chance. That’s why we help you find a solution to make things clearer and easier.

In person, by phone or video conference

Our solutions

With the help of our Licensed Insolvency Trustees (LIT), a plan is developed to settle your debts and balance your budget.

Debt Consolidation

Debt consolidation is a debt solution where a financial institution grants you a single loan. This loan extends over a maximum period of 5 years and is used to pay off your other creditors.

Personal bankruptcy

When other debt solutions do not apply, personal bankruptcy is the last resort. It allows you to get rid of your debts and finally put an end to creditor harassment

Consumer Proposal

A consumer proposal is a solution that allows you to negotiate a reduction on your overall debt. You pay a lower monthly amount based on your current budget, not the minimum amount owed on your cards.

Commercial Services

Hiring a trustee allows businesses and professionals to get back on track. We have the resources to help you see more clearly.

Is your business experiencing financial difficulties? It is essential to choose a trusted partner to guide you through this process. Our expertise in bankruptcy and insolvency enables you to understand the options that apply to your situation.

In an unpredictable and ever-changing marketplace, there are many reasons why a business may experience financial problems. These include:

- Increased competitiveness;

- Loss of major clients;

- Unsustainable debts;

- Inadequate budget management;

- Decline in revenue and/or profitability;

- Losses in financial statements for two consecutive years;

- Declining market;

- Negative cash-flow due to excessive debt service.

Learn more and take control of your finances

How Wise Choices Can Be Money-Saving Tips

How Wise Choices Can Be Money-Saving Tips In a global context marked by uncertainty, many face the need to re-examine their spending habits. The recent economic crisis has shown us just how important it is to be in control of our finances. Making smart financial decisions is crucial now, more than ever before. Not

Construction insolvency : Protection for suppliers

TRUSTEE IN INSOLVENCY Construction insolvency : Protection for suppliers Are you a contractor or subcontractor in the construction industry? You should be aware that new mortgage regulations will soon be coming into effect. These new rules will have a direct impact on the rate of payment for subcontractors, as banks will be limiting access

How much does a consumer proposal cost ?

Consumer Proposal How much does a consumer proposal cost ? If you are overwhelmed by debt and looking at your credit report gives you anxiety, we have the solutions you need. M. Roy & Associés has the tools you require to regain financial stability without having to declare bankruptcy. For example, the consumer proposal,

« I was very nervous about going bankrupt, I thought I was going to lose everything. Ms. Beaulne put me at ease by taking the time to explain myself and to respond to all my concerns. They gave me a new breath. Thanks to everyone on the team! »

« I was very nervous about going bankrupt, I thought I was going to lose everything. Ms. Beaulne put me at ease by taking the time to explain myself and to respond to all my concerns. They gave me a new breath. Thanks to everyone on the team! »

« I was very nervous about going bankrupt, I thought I was going to lose everything. Ms. Beaulne put me at ease by taking the time to explain myself and to respond to all my concerns. They gave me a new breath. Thanks to everyone on the team! »